A post COVID-19 outlook on automotive: lessons from China and opportunities ahead

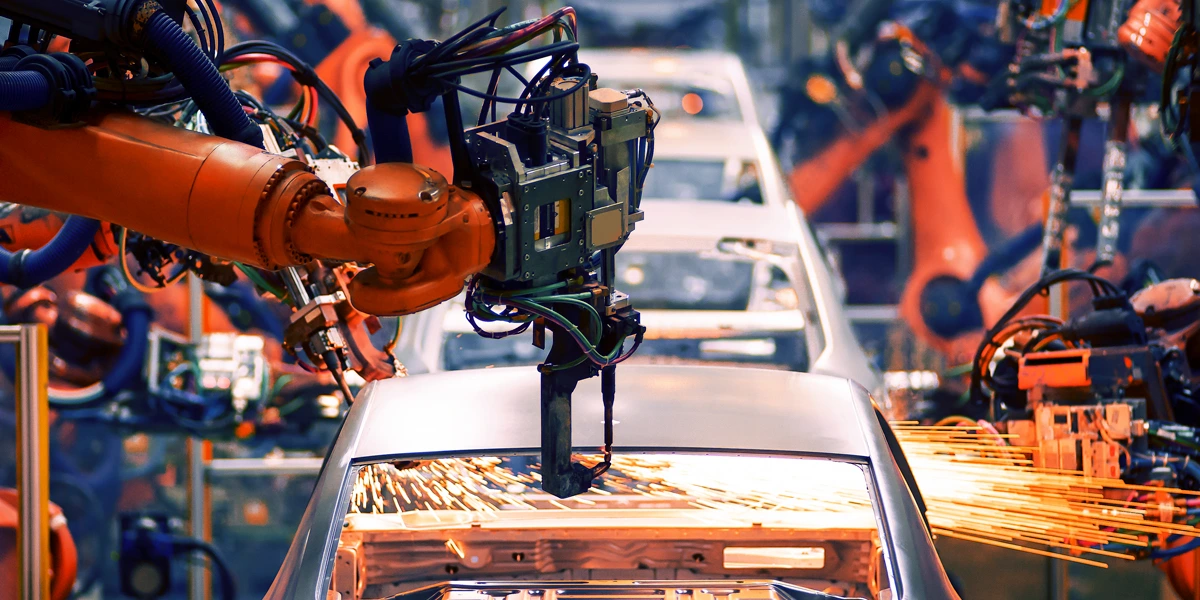

From assembling a vehicle every 50-55 seconds with seamless support from ancillary suppliers, to a complete operational standstill, automakers globally are grappling with COVID-19 based disruptions. Most automotive plants rely on the JIT (Just-in-Time) production principle of readily available components, making the supply chain very fragile.

Moreover, with different geographies enforcing and lifting the COVID-19 triggered lockdowns at different times, the automotive supply chain is far from being restored to normalcy. Given that OEMs pocket their revenues when vehicles are shipped to the dealer/fleet operator, automakers are eager to quickly restart their assembly lines in order to rejuvenate the market. However, there are a few major challenges that hinder companies from achieving that.

A ‘C’ shaped supply gap may halt operations post restart

China, Japan, and South Korea are regions that contribute a significant share of tier-2 and tier-3 components. Since these countries were four to six weeks ahead into the virus infection curve compared to the West, the differences in lockdown periods have resulted in inventory imbalances.

By the time Europe and North America shut down its factories, they had largely exhausted their existing inventory indicating that when the assembly plants do restart, they will immediately run short of parts resulting in forced shutdown again. Given that many factories in China are now operational, OEMs (Original Equipment Manufacturers) may have to closely monitor the ports and cargo movement to mitigate this risk.

Uneven relaxation of lockdown at different timelines could lead to bottlenecks

Relaxation in a particular country/province/state could lead to bottlenecks in the auto-parts supply chain. For instance, the US state of Michigan has the highest quantity of assembly parts while Ohio and Indiana have notable supplier bases. If Michigan relaxes restrictions on automotive operations, its assembly plants may not function effectively, if at the same time Ohio or Indiana continue with their restrictions. The outcome would be a lack of supply from ancillary manufacturers based in those states.

Hence, given the interconnectedness of supply networks across regions, countries, and states, it will be critical for all stakeholders to start functioning concurrently in an effort to align and synchronize automobile production.

Health and safety concerns

Given the extensive network of these supply chains, it is highly crucial that all participants carefully plan and implement new operational guidelines for a post-COVID world. OEMs will have to take the onus of health and safety guidelines for all its supply chain participants. This is more so because most tier-2 or tier-3 suppliers are small family-run businesses.

How China is handling the crisis

The automotive industry in China, already strained due to the rising tensions of the 2017 US-China trade war, was further crippled by COVID-19, causing a severe dip in the demand for new vehicles. The below graph showcases its sales trajectory.

However, as the lockdown is gradually being lifted, economic activity across the nation is gaining momentum, signaling a positive light amid the COVID-19 automotive impact. The Chinese government and automakers are expected to work closely to revive the industry, with the government aiming to offer notable stimulus for boosting automotive demand. Here are a few measures that the Chinese government implemented by the end of April 2020:

- Major cities within the country are easing their regulatory limits on issuing license plate

- Electric vehicle quota shave been temporarily eased to ensure automakers focus on high-margin Internal Combustion Engine (ICE) vehicles

- China Association of Automobile Manufacturers or CAAM has proposed to delay the nationwide implementation of the China-VI Emission standard. Previously, vehicles from July 1, 2020 were required to meet the China 6A standard for light-duty vehicles

Emerging trends in the automobile industry

Just like every dark cloud has a silver lining, with each crisis, new business opportunities and trends emerge. Here’s a quick overview of the trends triggered by this pandemic.

- Entry level/low cost vehicles: Demand for private vehicles will quickly rebound with many more first-time buyers, as people try to avoid public transport post the lockdown. Customers would perceive private vehicles as a necessary defense mechanism against COVID-19

- Automotive textiles: OEMs will develop materials that could be anti-bacterial or amenable to sharing among passengers. This will be a key purchasing attribute from fleet operators in the near-term.

- Air quality management: Usage of air filters embedded in-vehicle HVAC systems and measuring the cabin air quality using HEPA technology will gain traction.

- Connected health monitoring systems: An increasing demand for connected health attributes such as emergency calls, health and wellness monitoring systems, and data input for healthcare providers is expected.

Read more: Impact of COVID-19 on micro-mobility

How Netscribes can help

The COVID-19 pandemic has landed most businesses in uncharted territory. To stay relevant and profitable, adapting to the post-COVID world will be vital. Netscribes helps businesses understand the changing environment through timely market intelligence and consumer insights. To know more, please contact us at info@netscibes.com.