2021: B2B e-commerce market trends and forecasts

2020 has been a rollercoaster ride for most organizations. Some slumped under unanticipated volatilities and rigid internal systems, while others were agile enough to lead their business through large-scale transformations. What’s important is that companies that made these strategic and timely moves saw and will continue to see light at the end of the tunnel. Keeping a watch on B2B e-commerce market trends is one step in that direction. Amid these unprecedented times, B2B players have experienced the advantages B2B platforms bestow in the form of increased brand awareness and revenue.

According to Digital Commerce 360, 2019 saw online sales on B2B e-commerce sites, log-in portals, and marketplaces increase by 18.2% to USD 1.3 trillion. Looking ahead, the global B2B e-commerce market is expected to grow to a CAGR of 17.5% by 2027, given rising internet penetration and a gamut of B2B online platform options, especially in the APAC region. To help B2B companies further strengthen their strategy for this year, our market analysts put their ears to the ground to provide a comprehensive outlook into the future. Here are a few excerpts:

Global overview

The 2020 B2B e-commerce market saw an array of rapid developments and accelerated adoption rates owing to the pandemic. B2B customers in the US, Germany, Italy, Spain, China, India, and Russia quickly made the online switch for their business needs. Going forward, the supplier-oriented B2B segment will expand significantly, as suppliers are expected to be easily accessible on a common platform. More mergers and acquisitions are on the cards as companies join forces to strengthen their internal or market-driven capabilities. In January 2020, Visa acquired Plaid, a financial services company, for their API platform for USD 5.3 billion. In June, Mastercard acquired Finicity, an open-banking service provider, for USD 825 million. In the same month, Alibaba added digital features like trade financing and freight features, to enhance the digital experience of their B2B customers.

COVID-19 impact across the industry

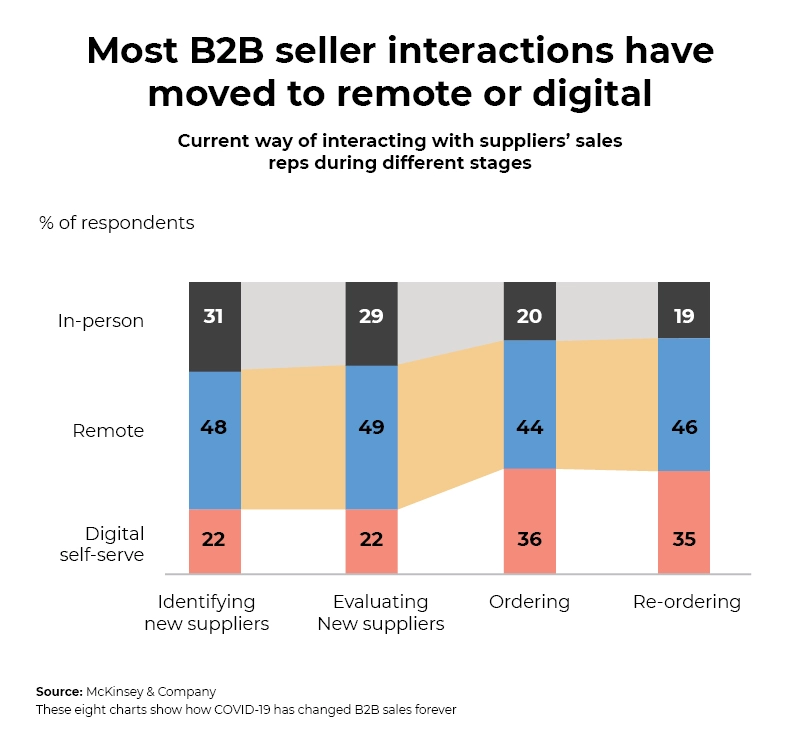

One of the stark B2B e-commerce market trends in the past year – eight out of ten companies faced supply chain issues during the onset of the pandemic. This scenario also exposed vulnerabilities for firms majorly dependent on China, compelling them to look for similar operations in their home country. While B2B players experienced a drop in traffic by more than half of their pre-pandemic levels, a recent survey showed that looking forward, 96% of companies are expecting an increase in online sales by more than 25%. And that’s exactly the trajectory we’re heading towards with most B2B buyers more than glad to use remote assistance or self-service options.

The crisis accelerated digital adoption at both the buying and selling end. Companies, therefore, found themselves making major digital and technology investments to quickly pivot to the need of the hour. Among other much-needed process adjustments, increasing operational capacity at home-based centers took priority while reducing dependencies on China and similar COVID-19 hotspots followed close. Lastly, companies were actively looking to better diversify their supply chains by scouting for potential secondary fulfillment centers.

Read more: Five consumer habits expected to stick post COVID-19

Customer experience: a unanimous priority

With traditional channels becoming increasingly redundant, firms realized they needed to think beyond the in-person sales pitch. Aspects like virtual product walkthroughs by a salesperson, to end-to-end self-service models, are making all the difference. According to McKinsey, about 70-80% of decision-makers prefer these kinds of interactions. It’s no surprise why 94.5% of B2B companies consider customer experience as key in boosting online visibility.

Offering seamless connected omnichannel experiences is one of the biggest priorities. Creating well- researched, personalized, need-based product information along with offering live chat support will be on the radar for many. Even as the pandemic coerced companies to take baby steps into e-commerce, it will claim a lion’s share of the technology budget as other sales channels get put on the backburner.

Regional digital B2B e-commerce adoption trends

Commanding the highest adoption in the US, Italy, and India, video conference has emerged as a critical channel for product demonstrations, price negotiations, customer support, and account management activities. In fact, 2019 saw B2B e-commerce grow 9 times faster than the growth in all US accounting for 51.4% of all manufacturing and distributor/wholesaler electronic sales in the country. Yet, it has seen significantly low adoption in Germany, Spain, and South Korea.

As for completely digital, end-to-end self-serving platforms, B2B buyers in the US consider it their most preferred channel. When it comes to spending online, a majority of UK and South Korean buyers don’t mind shelling out more than 50,000 USD online.

When compared between the US, Europe, and APAC region, the highest effectiveness of digital-sales-as- a-model is earned by APAC, followed by the US. Within Europe, it’s the UK that claims that title. Among those contemplating on advancing their sales capabilities and technologies, Spain and South Korea lead the transformation league.

Strategic trends and focus areas

Increased spends on digital channels

Globally, 75% of B2B companies found their digital sales model effective in reaching out to buyers and will continue to leverage such platforms. With no end to the pandemic in sight, 70% of B2B decision-makers say they are comfortable spending more than USD 50,000, while 27% are comfortable spending more than USD 500,000.

Rise in millennial shoppers

Millennials make up a major share of the current workforce. 73% of them are online B2B buyers and they prefer conducting their own research online rather than speaking to a salesperson. This way they can make better informed, unbiased purchases.

Video and live chat adoption

Among channels driving the “ka-ching” moment, video and live chats are topping the charts. Moreover, since COVID-19, the preference for video conference platforms increased from 38% to 53% and that for the online chat channels from 40% to 49%.

Low touch delivery

As buyers look for minimal or no in-person interactions across the shopping journey, they expect workarounds for product/ service delivery as well. Therefore, companies are currently focusing on building long-term strategies to address this lasting demand.

Technology trends in B2B e-commerce

Needless to say, technology is at the heart of the entire end-to-end execution of the B2B e-commerce strategy. Here’s how each of these aspects plays a critical role in defining a stellar business customer experience and should be considered by firms who take pride in being digitally forward:

Artificial Intelligence and Chatbots

According to Forrester, 57% of B2B sales leaders plan to invest in AI and automation tools in 2021. 33% of B2B buyers consider chatbots as one of the major engagement channels in their buying journey. Moreover, AI offers predictive maintenance capabilities that help minimize process and equipment downtime at fulfillment centers.

Augmented Reality (AR) and Virtual Reality (VR)

Leveraging AR and VR can boost buyer confidence enabling a life-like product experience, despite lockdown restrictions. A number of industrial equipment companies have already adopted AR/VR to increase their production efficiency, training, sales, and marketing activities. This trend is expected to sustain post the pandemic given its advanced remote capabilities.

Analytics

Companies are adopting advanced analytics to improve sales and gain granular actionable insights on buyer behavior.

Application Program Interface (API)-driven Platform

API-driven e-commerce solutions facilitate faster innovation and meet changing customer demands. 86% of banks consider B2B APIs as their innovation priority.

Read more: How consumer electronics e-commerce is getting a technological makeover

Progressive Web Apps (PWAs)

PWAs are designed to work across all mobile devices and operating systems. By developing PWAs for their business, B2B players save on mobile app investments while offering buyers a more app-less, hassle-free, and seamless shopping journey with the same in-app like experience.

While this is a fair outlook into the future, savvy B2B companies seek to better evaluate their buyer personas, stakeholder seniority, and the tonality of their marketing messages among other aspects to meet their prospects at the right crossroads. A granular competitive analysis and constant monitoring of evolving B2B e-commerce market trends will serve such insights to help you make the right investments and strategic moves for the road ahead.

Read more: Podcasting for B2B marketers: The 7 best practices

With over two decades of global industry experience, B2B players across sectors partner with Netscribes to understand and competitively cater to evolving market and buyer needs. If you are looking for deeper market insights to improve your digital B2B e-commerce experience, we can help. Contact us today.