Which companies lead the connected-car patent race?

With connectivity set to become the new automotive paradigm, the race to acquire connected car patents has become increasingly competitive. Our IP research suggests that the year 2018 saw a 132% increase in the number of published connected car patents since 2016 – the highest ever. We took a closer look at the patent filing trends over the last 10 years to find out which companies hold the most number of patents in the connected car space and their key focus areas. Read on to see what we found.

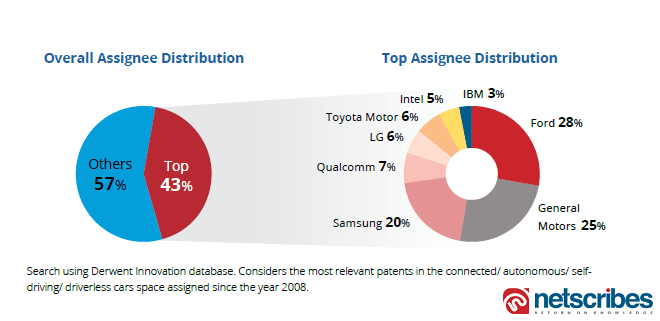

Ford, General Motors dominate connected car patents

Of the total 1746 patents considered as relevant and analyzed in the study, about 43% were assigned to the top nine assignees – Ford, General Motors, Samsung, Qualcomm, LG, Toyota Motor, Intel, IBM, and Honda Motor. Among the remaining 57% were by companies like Bosch, Google, Hyundai, Delphi/Aptiv, and Microsoft.

With over 200 patents, Ford has the highest number of connected car patents, followed by General Motors with 180 patents. Other automakers and OEMs with a significant number of connected car patents include Toyota, Honda, Magna, and Bosch. Among the top 40 patent assignees are also insurance companies such as AllState and State Farm.

Non-auto-makers most active in connected car patenting

About 60% of the patent publications in the connected car space have been filed by about 40 of the most active assignees. Of these top 40 patent assignees, only 18 are automakers or OEMs such as Ford, General Motors, and Bosch. The rest of the patents are owned by non-automakers, including network and software providers and semiconductor companies. These companies focus on crucial automotive IoT technologies that provide driver assistance, navigation, sensors, and wireless communication among others.

Some of the most active companies include Samsung, LG, IBM, Google, Microsoft, Verizon Communications, Honeywell, and Ericsson, to name a few. The table below shows an indicative list of the patent focus areas of some of these companies.

Analyzing the IP and patent filing trends is an integral part of understanding the R&D strategies and roadmaps of market players in the innovation-driven automotive sector. The development and commercialization of disruptive technologies is known to have a direct correlation to the patenting trends. Reviewing the patents filed by entities such as corporates, universities, and institutes is, therefore, key to identifying the emerging technology trends and predicting disruptions. Patent protection strategies based on such analyses are critical to ensure market success, secure protection for R&D activity and investments, increase revenue by targeting whitespaces in a domain either through royalties or commercialization.

Read more: Connected vehicles in India: A peek into the emerging trends and outlook for the future

If you’re looking to track or analyze the patents in a specific technological field, we can help. Read about our IP research services to know how.