FemTech and its evolution from niche to mainstream

Who run the world? Girls! Yes indeed – Women represent half of the world’s population. However, when it comes to healthcare, firms catering to specific women’s health conditions are still quite rare. The post-COVID era has seen accelerated funding for FemTech, with this segment’s global venture capital funding crossing the USD 1.2 billion mark for the first time ever, in 2021.

Now that the FemTech revolution has begun, it’s leading to better health outcomes for women and new opportunities for investors, companies, employees, and other stakeholders throughout the healthcare ecosystem. In just a few years, this market has expanded to include a wide range of technology-enabled, consumer-centric products and services.

While some see FemTech as solely focused on pregnancy or menstrual apps, it actually encompasses a wide range of solutions for female-specific conditions, such as pelvic and sexual health, fertility, menopause, and contraception, as well as a variety of general health conditions that affect women disproportionately or differently (such as osteoporosis or cardiovascular disease).

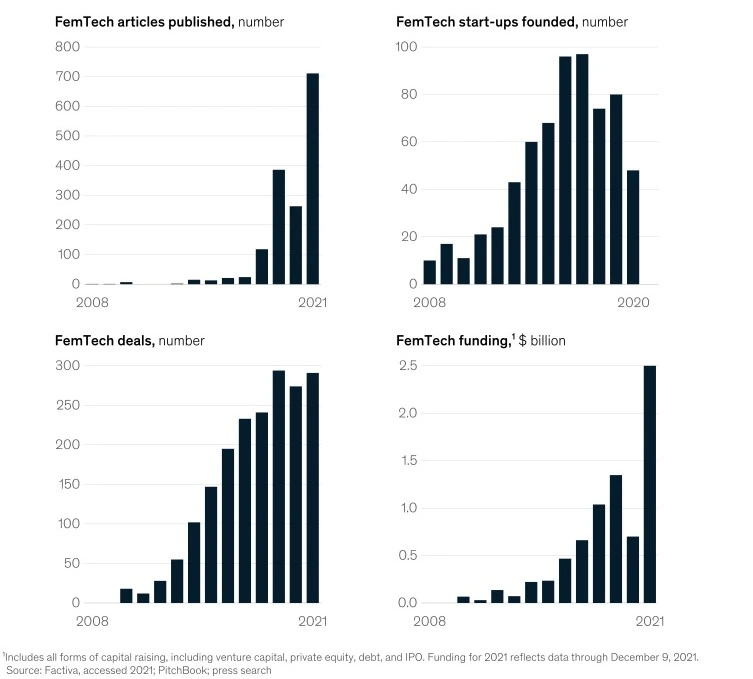

While it’s still early days, current research findings suggest that the FemTech dynamics are speeding up: Public awareness, business formation, and finance are all on the rise.

Source: Mckinsey Research

Several companies in the FemTech sector are already surpassing billion dollar valuations. Progyny, which oversees employer-provided fertility benefits, went public in 2019 at a valuation of more than USD 1 billion; its current market capitalization is around USD 4 billion. In a recent Series D investment, Maven Clinic, a virtual clinic for women’s and family health, was valued at more than USD 1 billion. Numerous actors in this segment, such as investors, researchers, providers, payers, and traditional pharmaceutical and medical-device businesses, are increasingly seeing its potential.

The need for FemTech

Up to 45% of women across the world have particular chronic ailments such polycystosis, endometriosis, autoimmune diseases, and hormone problems, and they spend USD 1,000-3,000 each year to treat the symptoms. Despite this, women’s health receives only 4% of global medical research funding.

However, women are increasingly filling traditionally male-dominated tech positions. As this representation develops, so does public knowledge of health issues that disproportionately affect women, and the growing interest in women’s health treatments.

Market opportunities in FemTech

FemTech’s present market size is estimated to be between USD 500 million and USD 1 billion, depending on the scope. Forecasts indicate that revenue growth could be in the double digits, as FemTech firms are now receiving 3% of all digital health funding. A study by Mckinsey has discovered a concentration in maternal health patient assistance, consumer menstrual products, gynecological gadgets, and fertility treatments.

The same study revealed that by early December 2021, funding for this sector reached USD 2.5 billion. In certain cases, such as in the area of maternal health, FemTech startups are addressing gaps that biopharma and device incumbents have yet to address. However, this is certainly simply the beginning of what FemTech can accomplish.

Source: Mckinsey Research

Women are becoming more particular about the products they use as the number of entrepreneurs entering into femtech grows. Femtech works to encourage new ways to educate and de-stigmatize issues affecting girls and women around the world while also encouraging environmental awareness

Companies are employing AI-enabled molding machines to mass-produce biodegradable disposable or reusable period care tech items like menstrual cups, for example, to minimize the massive waste burden. Such hygiene solutions are expected to assist accomplish UN 2030 sustainability goals #5 and #6 while lowering economic and environmental expenses.

What does the future look like for FemTech?

Moving forward, early FemTech adopters can capitalize upon visible white spaces in this industry, such as harnessing technology to address women’s health issues beyond maternity and assisting marginalized populations such as low-income or minority communities.

FemTech also offers established firms in traditional sectors significant partnership potential. L’Oréal, the world’s largest cosmetics company, recently announced a collaboration with the period-tracking app Clue to learn more about the link between skin health and the menstrual cycle. Stakeholders within and outside the healthcare ecosystem may very well give further momentum as FemTech companies gain traction and transform the competitive landscape.

Let’s not overlook the fact that FemTech—and better women’s healthcare in general—could help accelerate societal improvements throughout the healthcare ecosystem and beyond. Consider menopause, which happens at a time when women are most likely to advance in their careers. Its consequences could have an impact on the number of women in senior positions and the quality of women’s experiences. The adoption of technological and consumer-focused solutions to combat menopause related issues can serve as a paradigm and facilitator for future female leaders. Such solutions are ultimately empowering people across the globe, and helping them find solutions to longstanding women’s health issues.

“FemTech is still in its early phase. However, in the coming 5 to 10 years, it is expected to become one of the most profitable sectors. Driven by enormous growth potential of this industry, the majority of biopharmaceutical companies across the globe are also devoting share of their budgets towards women’s health, showcasing a bright future for FemTech.”

– Preeti Kumari, Manager – Healthcare, Market Intelligence team, Netscribes.

Based on insights by Preeti Kumari – Manager, Healthcare Market Intelligence team, Netscribes.