How fintech startups are disrupting the lending industry

Technology has become ubiquitous to a throng of industries and continues to gain momentum as it answers newer challenges every day. In the lending industry, emerging fintech companies are already luring a huge chunk of a long under-served audience seeking capital – SMB owners, the fuel powering the US economy.

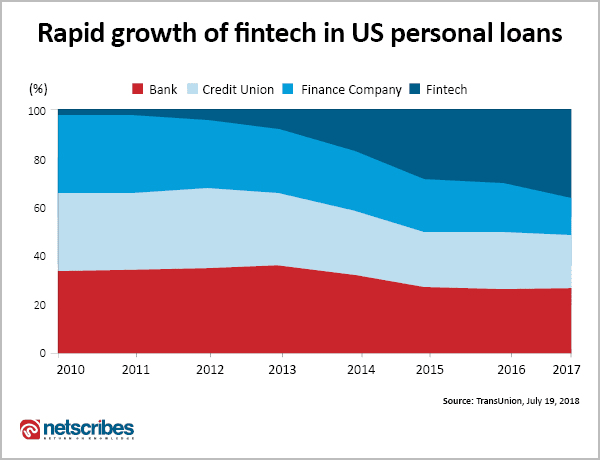

While banks are reluctant in extending a helping hand ever since the Recession of 2008, the market has never been riper for disruption. Here’s where leading fintech startups are promising a financial inclusion that has hardly seen the light of day until a few years ago. It is no wonder that Fintech firms like LendingClub, Prosper, and Avant account for about a third of personal lending, up from less than 1% in 2010, according to a recent survey conducted by Gartner.

P2P lending platforms

One of the most resounding reasons why banks and other financial lending institutions choose to stay highhanded with the SMB sector is the economies of scale. Why do the same paperwork for a lesser loan amount, when a larger sum incurs the same operational cost? Enter fintech startups. Largely employing peer-to-peer lending as a business model, these innovators replace long and arduous paperwork with automation and rule-based algorithms that screen applicants, enable quicker decision-making, and disburse loans seamlessly. Firms like LendingClub and Prosper simply offer a platform where individuals earn interest by lending, while the firm accrues a nominal brokerage fee for establishing the connection. The difference here, unlike a strict credit rating system that supports your borrowing plan, is that you instead work to gain your lender’s consideration through a compelling proof of concept of your business plan.

Upping the game with big data

Data is the lifeblood of any financial business, more so for fintech lenders. To ensure they take calculated risks, these startups crunch scores of data from non-traditional sources to determine a borrower’s creditworthiness and ability to repay. Most fintech lenders are using their own algorithms to evaluate borrower credit risk which, in many cases, is helping consumers enhance their credit access. With rapid advancements in technology, fintech lending startups are aiming to deploy predictive analytics to know when an SMB will require a loan even before the business owner realizes it.

Reduced costs through automation

Fintechs startups incorporate technology into each process silo, which enables easier and cheaper ways to save, borrow, spend and invest. This helps lower operating costs substantially by automating risk assessment and underwriting; an area where traditional banks relied on human skill. This overall lowering of costs translates into a great opportunity for fintech lending startups to slash down interest rates for borrowers. Moreover, in the matter of approvals and disbursement, what would take weeks for banks or credit card providers, is a task completed in less 24 hours and, in some cases, as quick as seven minutes by fintech lenders.

Effortless repayments

Debt collection remains one of the most onerous aspects for both lenders and borrowers. Current debt collection processes are antiquated and involve multiple levels of handling and repetitive functions with very little integration between them. This hampers debt collection success and results in an unpleasant experience for customers. Fintech startups such as Symend and Habile Technologies are leveraging automation and digitized loan repayment strategies to increase collection efficiency and improve the repayment experience for customers.

Niche offerings and scalability

Gaining popularity among small and medium businesses, fintech lending platforms are constantly exploring and venturing into this market. Startups like Earnest and Sofi are now offering financing solutions for student loans, mortgages and personal loans. These products cater to a consumer audience that would otherwise never be able to acquire collateral-less credit from legacy-bound banks and other financial institutions. Other players in this space offer a plethora of similar solutions like business lines of credit, invoice financing, and factor loans.

A recent survey on the financial services industry by Gartner states that 70 percent of respondents considered fintech startups to be a bigger threat than their traditional rivals. With fintech newbies constantly ripping the rule book to emerge with newer innovations and unique offerings every day, will established banks collaborate or compete with this burgeoning league remains to be seen.

Read more: Insurance industry trends and outlook 2021

If you’re looking for more granular market insights into the impact of fintech on the lending industry or any other vertical in the financial services domain, contact us at info@netscribes.com.